ESMA issues Opinion on RTS under ELTIF 2.0

In a recent Opinion (here), the European Securities and Markets Authority (“ESMA”) suggested limited changes to amendments proposed by the European Commission to the draft regulatory technical standards (“RTS”) under the revised regulatory framework for European long-term investment funds1 (the “ELTIF Regulation” or “ELTIF 2.0”).

According to ESMA, its proposed changes would strike a more appropriate balance between protecting retail investors and contributing to the objectives of the EU Capital Markets Union.

Background

ELTIF 2.0 (see our earlier briefing here) provides that ESMA shall develop draft RTS to determine the following:

- the criteria for establishing the circumstances in which the use of financial derivative instruments solely serves the purpose of hedging the risks inherent to other investments of the ELTIF;

- the circumstances in which the life of an ELTIF is considered compatible with the life cycles of each of the individual assets, as well as different features of the redemption policy of the ELTIF;

- the circumstances for the use of the matching mechanism (i.e., the possibility of full or partial matching (before the end of the life of the ELTIF) of transfer requests of units or shares of the ELTIF by exiting ELTIF investors with transfer requests by potential investors);

- the criteria to be used for certain elements of the itemised schedule for the orderly disposal of the ELTIF assets; and

- the costs disclosure.

On 19 December 2023, ESMA published finalised draft RTS addressing each of the above, and submitted those to the European Commission for endorsement.

On 8 March 2024, ESMA received a letter from the European Commission stating that “ESMA’s draft RTS [did] not sufficiently cater for the individual characteristics of different ELTIFs” and that it would be necessary to take “a more proportionate approach” to the drafting of the RTS, in particular with regard to the calibration of the requirements relating to redemptions and liquidity management tools.

The Commission informed ESMA that it intended to adopt the proposed RTS with amendments, which were submitted to ESMA as an Annex to the letter. The Commission invited ESMA to submit revised draft RTS reflecting the amendments set out in the Annex.

Now, ESMA has suggested a limited number of changes to the amendments proposed by the Commission; those suggested changes are outlined below.

Key Changes proposed by ESMA

(i) Minimum Notice Period2

ESMA has proposed the deletion of Annex I of the draft Delegated Regulation. According to ESMA, deletion is necessary because the first option proposed by the Commission “does not make it mandatory for the ELTIF manager to hold minimum percentages of liquid assets, and given that option also implies that in certain circumstances (e.g. no notice period and weekly redemption frequency) the maximum amount that can be redeemed is less than 2%, which does not seem compatible with the fact that retail investors may invest in ELTIF given they may not be aware nor understand that redemptions could be limited to that extent”.

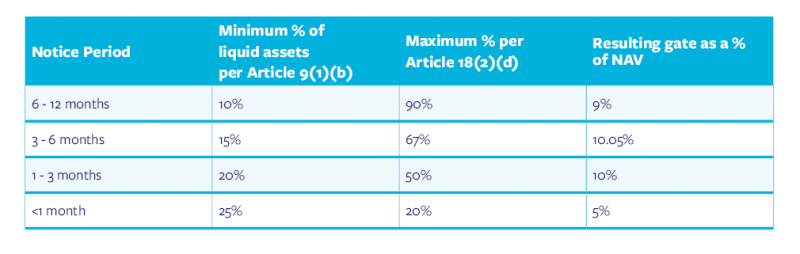

ESMA proposes the retention of Annex II, but suggests replacing “redemption frequency” with “notice period” in the first column of the table (replicated below). According to ESMA, managers of ELTIFs would not, otherwise, “have time to stagger the sales of assets, if all redemption requests were formulated one day before the redemption day”.

(ii) Redemption Gates3

Rather than deleting all references to “gates” in the draft RTS, as suggested by the European Commission, ESMA proposes replacing the requirement to implement redemption gates with the following wording: “The manager of the ELTIF may also implement redemption gates, in particular if the amount of liquid assets is not sufficient to cover a reasonable expected redemption at the redemption dates”.

(iii) Liquidity Management Tools4

ESMA suggests deleting the Commission’s additional wording on the “extension of notice period”. According to ESMA, the additional wording would risk confusing between, on the one hand, the minimum notice period of the fund, and on the other hand, the extension of such notice period, which is a liquidity management tool.

(iv) Notification of material changes5

Rather than deleting Article 4(2), as suggested by the European Commission, ESMA suggests amending the wording to require that a manager of an ELTIF give at least one month’s notice to the national competent authority before implementing a material change or, if it is unplanned, notify as soon as the change becomes known to the manager.

Next Steps

Following communication of ESMA’s Opinion to the European Commission, the Commission may adopt ESMA’s suggested amendments, with or without amendments, or reject them. EFAMA and other industry bodies, including Irish Funds, have provided their views to the European Commission on the latest proposals set out in ESMA’s Opinion, with some continued pushback from industry on certain elements of the ESMA proposals. On final adoption of the RTS by the European Commission, the European Parliament and the Council of the EU will have a three-month period in which to object to the RTS.

Also contributed to by David O’Keeffe Ioiart

- Regulation (EU) 2023/606.

- Under Article 5(6) of the draft RTS submitted by the Commission.

- Under Article 5(8) of the draft RTS.

- Under Article 5(7) of the draft RTS.

- Under Article 4(2) of the draft RTS.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below